The Impact Of WWE’s Merger With UFC Under TKO Group Holdings

The merger of WWE and UFC under TKO Group Holdings heralds a tectonic shift in the landscape of sports entertainment. This union, which closed on September 12, 2023, has created a powerhouse that pairs the theatrical flair of professional wrestling with the raw intensity of mixed martial arts16. This merger goes far beyond inside the ring or octagon and touches base with several aspects of sports entertainment, changing the trend in which fans consume combat sports content.

Formation and Structure of TKO Group Holdings

TKO Group Holdings, Inc. (“TKO”) came alive as an American media conglomerate, forged by Endeavor, subsequent to the merger among WWE and Zuffa, the parent company of UFC. The transaction placed an evaluation of over $21 billion on the combined entity, with Endeavor holding 51% to give it a controlling interest and former WWE shareholders retaining 49%24.

The leadership structure of TKO reflects the strengths of both organizations:

Endeavor CEO Ari Emanuel is CEO of TKO.

Mark Shapiro serves as its president and chief operating officer.

Vince McMahon, WWE’s founder, assumes the role of executive chairman.

Dana White was named the CEO of UFC.

Nick Khan remains the president of WWE.

With decades of collective experience in sports, entertainment, and media, this leadership team positions TKO to leverage the best from both WWE and UFC.

Strategic Objectives and Possible Synergies

The merger will bring into existence a force that will be unparalleled in the sports entertainment landscape, capitalizing on the strengths of both WWE and UFC. Among the key objectives of the deal are:

Expanded Market Reach: With WWE having 1.2 billion followers on social media and UFC with 700 million followers, TKO will have access to a very large and varied audience base. 3.

Cross-promotion opportunities: The merger substantially opens avenues for creative shows and events that could incorporate crossovers with WWE and UFC talent in a whole new set of matches and storylines.

Improved Revenue Streams: In this merger, TKO will be able to create revenue streams through the holding of combined events, merchandising, and selling media rights. 3.

Stronger Bargaining Position: A packaged deal that includes both WWE and UFC content could give the company a better bargaining position when negotiating with broadcasters, streaming services, and arena operators.

Resource Sharing: From talent to production resources, the merger allows for better utilization of assets across both brands. 3.

Market Dominance: In putting together the two major players in their respective fields, TKO tries to hold off the up-and-coming competitors AEW in wrestling and Bellator in MMA.

Impact on Content and Programming

The merger is very likely to affect the kind of content both WWE and UFC produce and how that content is distributed to their fans.

Potential for New Content Formats

Imagine the new formats of content that could be developed, putting together the creative forces of WWE and UFC. The following could be considered:

Reality shows featuring WWE superstars and UFC fighters

A new documentary series will detail all their respective histories and rivalries of both organizations.

Special activity crossovers showcasing the talent and skill of athletes from WWE versus UFC.

Changes in event production and presentation

While WWE and UFC will operate under the parent company of TKO as separate divisions, there’s definitely some room for cross-pollination in terms of techniques of production:

UFC events might include much more of that flair WWE seems to do instinctively with spectacular entrances and creating a storyline setting.

The productions in WWE could somehow include some ideas from the UFC and give more emphasis to the athletic components of professional wrestling.

Media Rights and Distribution

Most impact because of the merger would be linked with media rights negotiations: the possibility to sell WWE and UFC together after existing contracts expire means an improved deal for the broadcasting and/or streaming company with which TKO closes a contract. This would make for:

More favorable terms in media rights agreements for the TKO

A potential standalone TKO streaming service for WWE and UFC content.

Greater leverage in overseas markets where one brand may be stronger than the other

Financial Implications and Market Position

The formation of TKO creates a sports entertainment behemoth with significant financial clout and market influence.

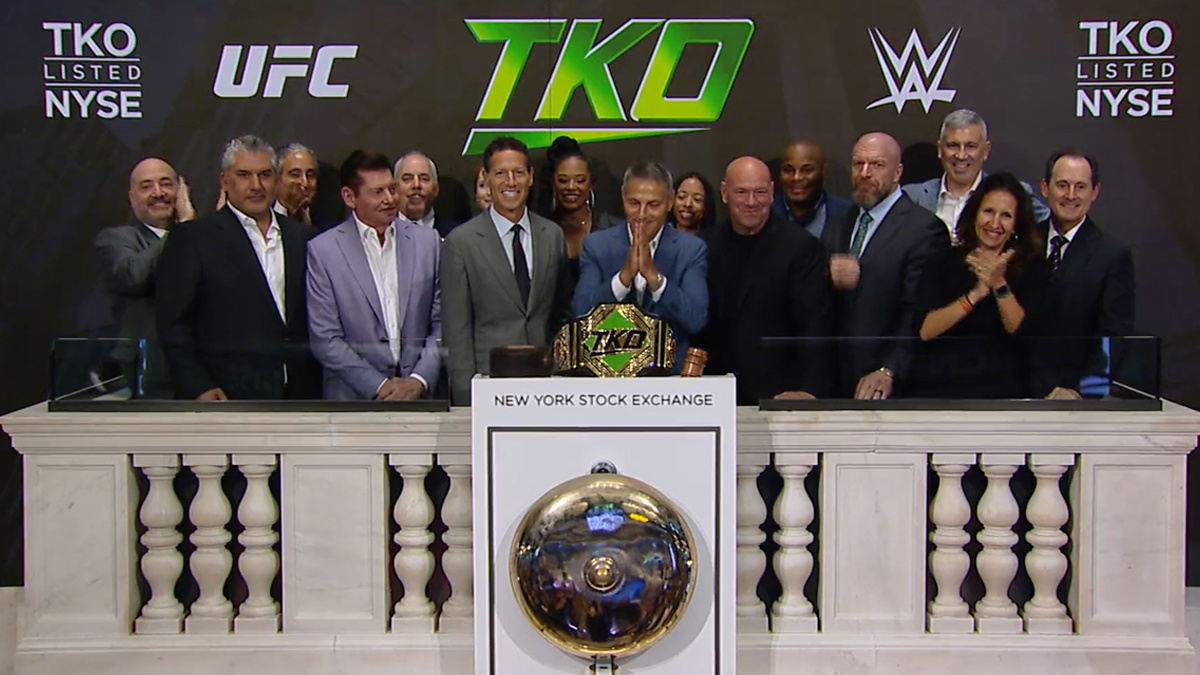

Valuation and Stock Performance

TKO’s shares started to trade on the New York Stock Exchange under the ticker symbol “TKO” on September 12, 20234. Of course, early market reaction and further performance of the stock will then be indicative of investors’ confidence in the merged entity.

Cost Synergies and Operational Efficiencies

By consolidating operations, TKO can achieve the following cost savings:

Shared corporate functions

Combined talent management and development programs

Joint marketing and promotional activities

Streamlined production and event management processes

International partnerships and sponsorships

Under one roof, the UFC and WWE global partnerships teams are an unmatched sports marketing portfolio for TKO. This integrated approach offers brands unparalleled opportunities for placement across two of the world’s most renowned sports and entertainment properties.

Challenges and Potential Hurdles

While the outlook looks promising, there are a number of challenges that may affect the success of this merger:

Cultural Integration

Both WWE and UFC have different cultures and fanbases. Finding a balance between the family-friendly entertainment that is WWE and the more hard-hitting, adult-oriented product put on by UFC is a tricky tightrope to walk in avoiding alienating either of those fanbases.

Regulatory Scrutiny

Just like in any other big merger case, there remains the likelihood of regulatory hurdles in front of the approval of TKOs regarding the concentricity of the markets for sports entertainment.

Existing Contractual Obligations

Both WWE and UFC have had previous contracts with different broadcasters and platforms that will also constrain some of the possible immediate integrations and innovations. These include:

WWE deals with Fox, Comcast, and Peacock

UFC’s deal with ESPN and Disney

These agreements will expire within the next 1-3 years, after which new deals will be negotiable by TKO3.

Talent Management

It will be very important to keep the stars of both brands happy and to manage the potential crossovers. There is a chance of talent loss due to performers who may feel their opportunities are limited or because they might be uncomfortable with changes to their respective brands. 3.

Impact on the Greater Sports and Entertainment Landscape

The rationale behind the creation of TKO has a lot more significant implications than just a matter of WWE versus UFC; rather, it could spill over into the entire sports and entertainment industry.

Competition and Market Dynamics

The merger could also spur a wave of consolidation among other sports and entertainment properties eager to match up with the scale and reach of TKO. This may lead to:

Increased merger and acquisition activity in the sector

Strategic alliances between smaller promotions and media firms

Something innovative in content creation and distribution that is different from what TKO is currently providing.

Fan Engagement and Experience

The combined resources and expertise of TKO could set a new standard for fan engagement:

Enhanced live event experiences that combine the best of WWE and UFC.

More engaging digital content and interaction through social media.

Increased merchandising and licensing opportunities

Global Expansion

With the combined international reach of WWE and UFC, TKO is well-positioned to expand into new markets:

Targeting regions where one brand is strong to introduce the other

Development of local content and talent to cater to particular international markets.

Leveraging global partnerships to enhance brand presence across the world.

Long-term vision and future prospects

Whether or not the merger will work out for TKO in the end has everything to do with how well it carries out its vision and adjusts to changing market circumstances.

Innovation in Content Delivery

As the ways in which people consume media change, TKO will have to continue to be among the most innovative in terms of content delivery:

Exploring virtual and augmented reality experiences for events

Developing mobile-first content strategies

Playing with new formats of live sports intertwined with scripted entertainment and viewer interactive elements.

Talent Development and Recruitment

TKO’s combined platform offers unique opportunities for athlete development:

Programs cross-training in both wrestling and MMA skills

Clear pathways for transition of athletes between WWE and UFC.

Attracting the best talent from other combat sports and entertainment industries.

Diversification in Revenue Streams

Long-term growth will probably be realized by TKO through diversification from its core wrestling and MMA offerings:

Expansion into other forms of live entertainment

Creation of original content on streaming platforms

Invest in sports technology and media companies.

Conclusion

The coming together of WWE and UFC under the TKO Group Holdings umbrella is a watershed moment in sports entertainment history. As TKO marries professional wrestling’s flair for theatrical storytelling with the competitive intensity of mixed martial arts, a monster entity of unparalleled reach and influence has been born.

Success here will require artful handling of the strong individual brand identities, strategic leveraging of combined resources, and innovation around content creation and distribution. If all goes well, the TKO merger has the potential to redefine how combat sports and entertainment are created, marketed, and consumed around the world.

As the landscape in sports and entertainment continues to change, all eyes will be on how this powerhouse of TKO weathers the storms of challenges and opportunities that lie ahead. The effect this merger will have could be felt for years to come, impacting everything from negotiations over media rights to how athletes build their careers in combat sports and entertainment.

In itself, TKO Group Holdings means the birth of a new era in sports entertainment—for both the ardent fan, the industry professional, and the investor alike—a proposition that may very well prove as dynamic and unpredictable as the performances, both in the ring and the octagon.